A Century-Old Family Business Comes of Age

- Tom White

- Haws Corporation

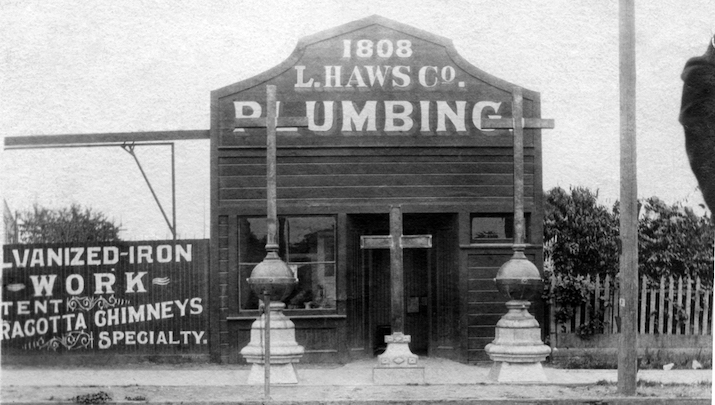

In 1993, when I joined our Evergreen® family business, Haws, the company was being operated by two grandsons of the founder—my father-in-law and one of his cousins. The company, which manufactures hydration and emergency response equipment, was founded in 1906, and the cousins represented third generation family leadership in the business.

When I stepped in, there was an unspoken understanding that the two cousins ran the business, and no other family members really asked questions. My wife has no recollection of any conversations around the business while she was growing up; family shareholder involvement was really non-existent.

Having spent my early career in the military—I had attended the Naval Academy and was still serving as an officer when my father-in-law approached me about joining the company—I entered into that landscape without expectations or awareness of best practices around governance. I didn’t have a roadmap.

In 2005, the potential for significant damage to the company in the absence of clear governance was highlighted when our family went through a challenging internal conflict that revealed the lack of hygiene in this area. As difficult as that period was, the outcome was positive: A commitment, as family stewards of our business, to do the governance work necessary to protect the business. Our efforts since that time have been transformative, and, we believe, will help ensure the long-term sustainability of our private, family ownership.

In reflecting on the key learnings of our family’s experience, there are steps we have taken and practices we have implemented that have been essential in creating the roadmap we now have to help grow the company for another 100 years:

Professional Facilitation for Effective Communication

It’s no secret that families don’t always do a great job communicating in general, even in the best of circumstances. In a family business, wherein family members are also shareholders, the situation can be ripe for miscommunication and heightened emotions.

We found that inviting a family facilitator to help us was incredibly helpful. This professional created a safe space in which we could have productive conversations that focused on the issues of the business, not personal history, and led to productive conclusions.

In seeking this help, we were lucky to find a professional who was a great fit for our family in tone, style, and expertise. This allowed our shareholders—who at the time ranged in age from 35 to 80—to feel comfortable in what is a potentially vulnerable situation and contribute to the conversation.

Family Council

The precedent of non-communication among family shareholders was initially a cultural barrier, harder to overcome than we had anticipated. But the formation of the family council and a regular cadence of family meetings allowed us to move forward. Very quickly, when we brought in our outside facilitators at our first meeting, everybody saw the walls come crumbling down. The collective reaction was, “Wow, this is actually really good work. I’m glad we’re doing it.”

The family council, which included G3 through G4 shareholders, became the vehicle that we used to discuss and implement governance. Two first critical steps in this process were the drafting of our family creed and guiding principles, which took several months for twelve members to agree upon. This was later followed by the crafting of a buy-sell agreement, which would come to serve us later.

Values and Guiding Principles

The development of our guiding principles through the family council forced us to ask, as a family, “What is important to us? What are our values?”

In our case, those conversations transformed our company in a way we didn’t expect. It became very clear as we discussed the business as an extended family, that in spite of the fact that my father-in-law and his cousin ran the business together for decades, they had very different values.

The two families were not aligned around the purpose of the business. Our side of the family was interested in investing in the business on a very long-term horizon; the other side was interested in extracting money out of the business and using it to support their lifestyle. We weren’t on the same page.

Our disparate views could have meant the end to our family business had we not engaged the family facilitator to help us through these challenging conversations. Through facilitation, we were able to avoid personal conflict and focus on the issues. One thing we agreed upon was increasing family accountability in the business, which resulted in a decision to establish a board that would include independent directors.

Board of Directors

As family owners working in the business, we wanted to be held accountable to what the larger group of family shareholders wanted us to deliver. If any one of us who held operating roles was not the best-qualified person for that position, we wanted that feedback from an objective board. And we got it. It was this board that within a year had decided that the family member running the business should be replaced. By now, G4 was running the business, and that decision ultimately led to my wife and her sister buying out their cousins for full control of the enterprise. In our case, we had to break the family apart to make the business stronger for the long term. We simply could not share business ownership and not share the same values.

Growing Together Today for a Healthy Future

We know that our work around governance is not over. In fact, it’s an ongoing practice. While we’ve established helpful foundational processes and guidelines, those are really just scaffolding for the many actions and decisions we make daily as a family in the business and as shareholders. We are continually reiterating our values, especially to the G5 shareholders, to ensure we remain aligned: “This is who we are. This is how we behave.” And, because we now have guidelines and established practices as family shareholders, if anyone has a question or says, “Hey, there’s a better way to do this,” we can get together and have a productive conversation.

Finally, the time and effort we have expended and continue to devote to this work has another, incredibly fulfilling upside: It brings us closer as a family. Serving the business together, sharing that responsibility and continually articulating what that means, connects us to one another and the long-term success of the gift we share.

Tom White is Chairman and CEO of Haws Corporation.

More Articles and Videos

Leading Through Uncertainty – Tugboat Institute® Summit 2025

- Jackie Hawkins

- Tugboat Institute

Why Employees Quit and How to Use Evergreen® Principles to Keep Them

- Michael Horn

- Clayton Christensen Center for Disruptive Innovation

Get Evergreen insight and wisdom delivered to your inbox every week

By signing up, you understand and agree that we will store, process and manage your personal information according to our Privacy Policy