Caring for the Caretakers

About 10 years ago, my mother was diagnosed with Alzheimer’s. It was an upsetting time for our family as we scrambled to find her help.

We hired two primary caregivers. One was basically a sitter who attended to my mother’s physical needs and little else. My mom’s dementia seemed to get worse every day she spent with her. The other caretaker, however, engaged my mother in conversation and encouraged her to take part in activities. When my mom spent time with this second person, her mood brightened.

It was nearly impossible to find anyone else, though, who could provide this kind of care. As a health care consultant, I’ve seen the system work from afar, but our struggle to find the right care for my mother put everything in a new perspective.

The reason it’s so hard to find great home care is not because of the people who are working in the industry — they are usually wonderful people who truly want to help — but because of the structure of most home health care companies.

Caregivers tend to have erratic schedules and often don’t know whose home they need to visit next. They often have no internal support, so if they find an agitated or ill client, they may not know how best to help them. As a result, it’s customary for caregivers to have very little loyalty or attachment to a home health care agency. It’s typical for a caregiver to carry IDs from five different agencies. And because they are not paid well (between $12 and $14 an hour in the Bay Area) they might neglect one call in order to take the better-paying gig. In turn, they tend to not bond with their clients or take any sense of pride in how their client might be reacting to their care. The average industry turnover is 60-70 percent.

As I worked to help my mother, I knew that I could also build a better home health care company by embracing the Evergreen concept of People First. That meant I had to completely rethink the home health care model when I founded Tender Rose in 2009.

That started with pay. We pay our workers $16 an hour and go up to $30. We offer annual raises and bonuses. If someone has to work overtime, we’ll send him or her a thank you with a gift card.

All of our workers who are full time (and that’s 70 percent of our staff) qualify for benefits after 30 days. We provide training and professional development and a lot of support in the field. Our caregivers can find themselves in very challenging situations with clients who might be acting up violently or who might be in the throes of a medical complication. We have two people on call 24/7 to offer our caregivers advice and guidance.

We also create room for advancement, so a fresh face can eventually become a field director and a mentor to others. We love to promote care coordinators from hourly to salaried workers who make $55,000 to $70,000 a year.

And we limit how many patients a caregiver is visiting. At Tender Rose, caregivers are assigned only two families at a time. This allows for bonding and consistency. Over time, the caregiver intimately learns what activities bring the client joy and meaning.

Treating our people right means that they are treating their patients right, and that’s been the highest mission of my organization. But offering this kind of care isn’t easy. We have to charge more than typical agencies — between $38 to $52 an hour compared with the $30 to $33 an hour most agencies charge. That’s meant embracing the Evergreen ideal of Paced Growth, which doesn’t bother me. I’d rather add clients gradually and be able to offer them the best care I can than to grow too fast and sacrifice quality care.

My mother passed away in 2015, and I take comfort in the fact that her final years were meaningful and happy. There’s great satisfaction in knowing we’re helping other families find that same comfort.

Jim Kimzey is the CEO of Tender Rose Dementia Care Specialists.

Family, Business

When I was 19, my father called my two younger siblings, my mother and me down to the dim low-ceilinged, windowless office in the basement of our family home in Bangor, Maine, for a solemn “family meeting” to discuss his business plans—and by consequence, our family’s fate. He had decided to exit the engineering consultancy he’d formed a few years earlier with his business partner whom he had grown to detest. “We’re going to start a new company, called The Fitch Company,” he said. He leaned back in his leather executive chair. It was important that we all understood and supported this idea.

To my ear, The Fitch Company sounded like an awkward name for an engineering outfit. But I sensed that this wasn’t really the best time to voice such concerns. After a bit of quiet reflection, my siblings and I did what any supportive family should in that situation. We held our tongues. We nodded. We hugged our father.

I thought of my father and his firm and our family often during this year’s Tugboat Institute Summit. More than 100 Evergreen business owners trekked to Sun Valley, Idaho, for the retreat. Several of the speakers at the summit talked about the joys and challenges of running a family business.

Listening to them, it hit me that there are striking paradoxes at the heart of the Evergreen way: It requires a towering sense of individualism but also demands vigorous support from family. You have to be willing to work incredibly hard, but as Tugboat founder Dave Whorton asks, “Why build an Evergreen business if you do not foster an Evergreen family?” He explains: “It goes both ways—you need their understanding and support, but as a leader, you also have to invest in your children’s development and, perhaps, foster their appreciation for your business.”

By support I don’t mean blind trust. Hell, family support can sometimes look curiously like opposition. John Keatley, the photographer celebrated for his portraiture, described to us a life-changing moment many years ago when he and his parents decided, quite soberly, that it was urgent that he abandon his budding photography practice entirely to focus upon his business-school studies. He reversed the decision the very next day when a manager at a local pharmacy took him aside and told him she liked the images in a roll of film she’d just processed for him. Still, his parents’ counsel stuck in other important ways. He has made sure to respect the business side of photography.

Sometimes, supporting your Evergreen family business also means tearing some of your parents’ and grandparents’ cherished ideals to shreds. Robert Pasin, owner and chief executive of Chicago-based Radio Flyer had to do exactly that to the storied wagon-making company that his grandfather Antonio started in 1923. Antonio had been trained as a cabinet-maker in Italy, and he obsessed over the details of running a highly efficient manufacturing operation. Robert recognized that Radio Flyer would never outlast the onslaught of lower-cost wagons from Asia. He refocused the company on design, branding and imagination. Though he had to lay off dozens of workers when he shuttered Radio Flyer’s factory in 2004, his company now attracts some of the best designers, marketers and creatives in the country. Radio Flyer wagons, tricycles, scooters are a secure mainstay of American childhood.

It’s not surprising that most family businesses either fall to pieces or are sold off before they pass to the second or third generation. If you study the few firms that do succeed at succession, you learn a lot. St. Louis Trust executive and Olin School of Business lecturer Spencer Burke has observed that multigenerational Evergreen families make sure “the equity ownership is controlled by a single person or entity that has a very long life.” Burke calls this “good hygiene.” They understand that once the clever chaps from the investment world get their hands on any equity, the exploitation begins. Instead, the later generations figure out ways to prune ownership and management responsibility. They buy out the negativists and look to supremely talented outsiders to manage things day to day, Burke says. They “embrace professional management at every level.”

Evergreen owners need not only supportive wives and children but also to be part of a supportive community where they can find brothers and sisters in arms. We found that once again in Sun Valley this year. When I greet people like author/journalist Bo Burlingham, bicycle-maker Ross Evans, logistician Tim Barrett, lifestyle-brander Carrie Van Winkle Greener or ice-cream demigoddess Amy Simmons, I embrace them warmly, like brothers and sisters. When I pick the brains of Stanford-trained business scholars like Calvin Tsay of Bi-Rite or Mac Harman of Balsam Brands, they share their tart insights as though they’re chatting with a sibling.

At least half of my conversations this year touched on the primal connection between our families and our businesses. There was the opening-night chat some of us had with Paul S. Mears III. Paul has struggled with mixed feelings as he puzzles over which, if any, of his four children might aspire to lead his Orlando-based limo, taxi and corporate-events firm that his grandfather founded in the 1930s and that his father ran before him. Paul and his brother now employ more than 3,500 people, and they’re battling fiercely against the disruptive ride-share powerhouses Uber and Lyft. The pair are in their prime now, but he’s already thinking way ahead to the long, draining days that his successor will inevitably face. “My grandfather was the senior Paul Mears, my father was Paul Jr., and I’m Paul the third,” he says. “My 20-year-old son is Paul Mears IV.” But the opportunity and challenge that is wrapped up in his son’s name is every bit as available to his three younger sisters. Paul III is readying himself for the weighty conversations that are, for now, still a ways down the road.

It’s a conversation that my father never had with me. He wisely transferred ownership of his firm not to any of us kids but to a brilliant young engineer whom I loved and who’s been a generous mentor to me. Still, I know that my Papa would be proud that when it came to assigning a moniker to my own company, I followed his lead. When I told my wife and daughter that I was naming the company FitchInk, they didn’t blink, they just hugged me tight.

Stephane Fitch is founder and editor in chief of content-marketing firm FitchInk, which helps some of the world’s biggest companies use thought-leading content to connect with audiences they value the most.

How Anthropology Can Help Evergreen Executives

Anthropology looks at how we went from an agrarian society to an industrial society to what is rapidly becoming a technological society. We look at these changes by getting up close and personal with specific groups, or “cultures.” Traditionally anthropologists studied indigenous peoples, but today they often focus on contemporary communities.

One culture to which you and I both belong: the community of businesspeople.

I didn’t study anthropology because I wanted to be better at business. I studied anthropology because I wanted to get a deeper understanding of how human beings interact and how they deal with change.

When I decided (after getting my Ph.D. in anthropology from Columbia University) to go into law, I thought that I would eventually view anthropology as a diversion from my true professional path. But what I found was that at every turn, from practicing law at a firm, to serving as general counsel at McCaw Cellular Communications Inc. and Netscape Communications Corp., to developing interdisciplinary study programs at Stanford University, I was always looking at my work through an anthropologic lens.

That’s because the questions we ask in anthropology are the same questions leaders need to ask themselves in order to build excellent, sustainable organizations. What are the different values people are bringing to this group? What is our group culture? And how can these people find new ways to work together in an ever-changing world?

Evergreen executives will recognize this as a People First mentality. If you’re Evergreen, chances are you’re already thinking about your people a lot and you already realize that their success is your success. But viewing your company as an (honorary) anthropologist will help you get an even deeper understanding of your organization and how you can make it even stronger. Here are three ways you can do so:

Encourage Flexibility

Society and institutions are always evolving. Look at the long history of human development. We’ve gone from living in isolated tribes and farming villages to being a constantly connected global community.

That’s big-scale change, but this kind of evolution is also happening on a more intimate level. Demand for a company’s product grows and subsides. A new deal requires internal growth. Or expansion into new markets means the company has to rethink who is responsible for what.

Understanding and accepting that everything is in flux is an important part of what makes societies succeed, and it’s crucial for businesses, as well. Never assume status quo, and make sure your people adopt a similar mentality. By encouraging flexibility, your organization will be able to grow and change more easily.

Focus On Your Company’s Values

Individuals have values, but so do institutions. Stanford, for example, values learning and giving back to society. Those two elements have to be part of everything our university does, and we need to impart these values to our students.

On a societal level, cultures are defined in part by the similar values held by their members. Businesses work slightly differently. An Evergreen CEO needs to know their company’s values, use them to support and protect their corporate culture and then make sure to hire people who are comfortable with these values.

It’s crucial that you understand and clearly articulate these values. What do you stand for? What’s the bigger purpose of your organization beyond making money?

Having strong values and a strong culture is even more important for Evergreen companies that want to survive for 100 years or more. The values you put in place today can help to keep the company leadership focused through successive generations.

Put Humans First

It might sound obvious to say that humans are at the center of every business, but as technology evolves, that’s no longer a given. I worry quite a bit that we’re not focused enough on people right now in our endless quest for efficiency. Automation might be good for the bottom line, but it isn’t always good for your organization.

That’s not to say that you shouldn’t use technology to improve your business. But leaders need to keep their people front and center as their companies evolve. Humans are the ones who are going to make your vision a reality, no matter how many robots or how much artificial intelligence you use. Making sure that those humans are comfortable with any change and that they know they are still valued is crucial for today’s organizations.

Evergreen companies are not immune to these changes. But with their People First outlook, they may be able to weather this evolution better than public companies that are so focused on the bottom line.

Taking the lessons of anthropology — putting humans first, understanding that everything changes and keeping your company’s focus on its values — will go a long way toward helping you build a sustainable business.

How Our Biggest Crisis Brought Our Company Together Again

In the franchise business, trust and respect are paramount. If your franchisees stop trusting you, they’ll stop caring for their customers, and the business risks falling apart.

This is something we’ve always known at Taco John’s, the 382-restaurant franchise where I am now president. But in 2013, we became dangerously distracted by profits and sales and almost lost that connection to our franchisees that, for me, has always made Taco John’s so special.

James Woodson and Harold W. Holmes franchised their Midwestern-based Mexican fast-food eatery in 1969. Many franchising companies own a majority of their restaurants, but we have only 10 company restaurants; the rest are all franchisees. I started here in 2000 as the director of technology.

In 2013, in an attempt to boost sales and grow the number of restaurants, we brought in a new CEO who applied a strict profit-focused strategy. While we didn’t see it at the time, this turned out to be a serious mistake.

Rather than consulting the franchisees and getting their buy-in as we always had, we started making changes straight from the top. We removed items from the menu, even when those items made up 8% of a restaurant’s annual sales. We dismissed our franchisee operations committee. We changed worktables from steam to dry heat, which was devastating to owners who love their old equipment. And we pushed franchisees to buy precooked taco meat rather than make it themselves—at an annual profit loss of $15,000 per restaurant.

By 2016, more and more of the franchisees were disillusioned and almost combative. We dropped from 405 to 382. We lost 57 employees from our Cheyenne, Wyoming, headquarters from 2013 to 2016. As a company, we felt we had been violently shaken. Our culture was in tatters. We realized we had to get back to our roots and that meant that as a company, we had come together.

I took over as president and chief executive officer in August 2016 and made it my goal to get back to our corporate culture of being more collaborative with our franchisees. I was lucky enough that our former head of human resources, who had 30 years of experience with the company, came back to help us regroup. Any time there’s a big change at the top, employees panic that they are going to be the next to go. She met with people and put an open-door policy in place to make sure that our 70 corporate employees felt safe and cared for and ready to work more closely with our franchisees.

Our vice president of finance and in-house general counsel stepped in to help keep the day-to-day business of our corporate headquarters going while I hit the road to visit, in person, as many of our franchisees as I could. I wanted to reassure them that we were once again going to be a company that listened to them and took their needs into consideration.

Our leadership team worked hard to reconstitute our committee system, which had always been the heart of Taco John’s culture but had broken down over a growing “us vs. them” mentality. Our committees are made up mostly of franchisees managers with our corporate personnel providing leadership. The committees make important decisions about matters such as menu changes, advertising and who will supply our restaurants. We made sure we had the right people on each committee to foster an atmosphere of cooperation.

We are also now planning to meet twice per year with the Association of Taco John’s Franchisees Board to ensure that we are all in alignment on brand priorities.

The effort is starting to pay off. A few weeks ago we had our annual national convention. I took the time to write every franchisee a hand-written invitation, and as a result, we had more people attending than for any conference in the last five years. For the first time in a long time, it felt like we were a family, who trusted one another again.

In his opening remarks, our franchisee association president said: “A new era of trust and cooperation has begun. We have a new leader who is working to rebuild relationships with shared ideas and a respect for the franchisees.” That’s more than I could have hoped for.

We are now at 382 franchises and expect to be back to 405 by the end of this year. Our team effort is paying off.

Jim Creel is the President & CEO of Taco John's International, Inc.

Why I Tell Students They Should Consider Family-Owned Businesses

Family businesses are, by their very nature, quiet. They don’t have to report on their financials, they tend not to promote themselves to investors, and any press can often mean unwanted attention on family dynamics.

So it’s not a huge surprise that most of the students I encounter through the business school at Loyola University aren’t thinking about family businesses as they assess their post-graduate job options. But as I like to tell them, if they don’t think about opportunities at family businesses, they’re shutting themselves off from what could be a very satisfying career.

I had my aha moment on family businesses around 2008. At the time, I was working at an outplacement company coaching C-suite executives who were looking for new jobs. In the wake of the financial collapse, many smart, talented people had been let go simply because their corporations needed to cut their budgets by 10 percent. These people hadn’t been let go for cause; they had been let go for purely financial reasons.

At the same time, I was consulting at the Family Business Center at the Quinlan School of Business at Loyola University in Chicago, where I am now the director. I was facilitating small groups of leaders from family-run businesses who were coming together for support and to learn from each other.

These executives were facing the same economic challenges as the big corporations that were laying off C-suite executives. But they were dealing with them very differently. They were being creative and purposeful about finding ways to retain their employees. They weren’t worried about their debt because they didn’t usually have much. They weren’t just thinking of themselves and their bottom line; they were thinking about what would be best for their entire work community.

I saw that family-run businesses have a different set of values, and that attracted me. I decided I wanted to work with people who are trying to create lasting value in their businesses and their communities.

There’s a lot of overlap between family-owned businesses and Evergreen companies, many of which are family-run today, or eventually family-run after the first generation. Both groups tend to put People First — paying as much attention to the growth and well-being of their employees and customers as they do to their Profits. Both groups tend to avoid outside investments and debt. And companies in both groups tend to have a deeply held Purpose that serves as their north star.

Twice a year I go into the classroom to make my pitch for family-run businesses. Here are the advantages I lay out for the graduate students:

A Bigger Mission

Millennials are children of the recession. They’ve learned that work needs to be about more than a paycheck — that it needs to be satisfying in a deeper way. So they’re looking for mission-based companies. Family-run businesses often fall into this category. Many family businesses that have been around for several generations have kept the company (and the family) together by having everyone focused on a bigger goal. That can be as simple as keeping the company in family hands or as big picture as trying to make the world a better place.

Opportunity To Advance

Public companies tend to be very rigid in their hiring and promoting policies. If you start at the bottom, you’ll have to work your way up through many layers in a way that could take years. Family businesses are different. They are usually just looking for the best people for the job and are looking for team members who are loyal and talented. And as an outsider to the family, new employees often have fresh ideas about how to make the business better. I tell the students they may find that they have more chances to advance more quickly at family businesses.

Sustainability

Students tend want the startup experience — where they jump into the chaos and excitement of a new company knowing it could all go away at any minute — or they want stability. For students looking for a more grounded environment, I recommend family-run businesses that have been around for three or four generations. Any company that old will have gone through almost everything the economy can throw at a company. It’ll be well-prepared to weather the next storm while remaining nimble and able to flex for the changing marketplace.

Responsibility To Employees

The average tenure for a CEO at a public company is five years. At family-run businesses it’s 20 years. CEOs and employees may have similar tenures and are mutually invested in the company and their teams. Family businesses also usually consider their businesses, and everyone who works there, as an extension of their actual family. That creates a sense of caring and responsibility that you don’t find at many public corporations.

Ability To Contribute

Our students leave school eager to dig in and play a real role wherever they decide to work. Recently I heard of a student who did an engineering internship at a family business. He developed a new product idea and the company let him lead the development team in building it.

All of this advice comes with caveats. Not every family-run business (just like not every Evergreen business) is the same, and ultimately the most important thing is finding a good professional, developmental and financial fit. But I’m glad to see the students putting family businesses into the mix more and more often. They are real assets to these companies and will find real satisfaction in their careers with them.

Anne Smart is the Director of Family Business Center within the Quinlan School of Business.

What A Bankruptcy Taught Me About Perseverance

You’ll never get another job. It’ll show up on your resume. They’ll see it on your credit report. These were my fears as our company, Miller Broadcasting, headed into Chapter 11 bankruptcy proceedings in 1996.

I was 33 at the time, and scared to be going through something I believed had such a stigma. And I was scared the stigma was deserved, because somehow this was my fault.

But now it’s over 20 years later, our business is doing well and I see that bankruptcy as a lesson. By going through the fire, I learned how to Persevere.

My family’s been in the media business since the 1880s. We have worked in most major forms of media, including newspapers, radio stations, TV stations and online. These days our company, Rocking M Media, is headquartered in Manhattan, Kansas, and we own 31 radio stations. I co-own Rocking M with my mom, Doris, and my dad, Monte.

Media’s not only in my blood — it’s been my career. I graduated from Kansas State University in 1986 with a BS in radio and television and immediately began working for my family’s media businesses. I started in the collections department at TeleGraphics, our newspaper business, and as vice president of sales for Miller Broadcasting, our television company. That was my job in 1996, when we faced our biggest crisis yet.

The main source of revenue for our Kansas City TV station was the Home Shopping Network. But that year, after HSN was sold to Barry Diller’s Silver King Broadcasting, the company reduced its payments to us by half. Silver King was looking to cut expenses as much as it could, and that meant cutting our budget.

We had taken out hefty loans to build the station, and with the reduced payments, the only way to restructure those loans was bankruptcy.

It was my responsibility to formulate and negotiate many aspects of the bankruptcy, though as a family business we were all involved. I had to develop and prepare all our spreadsheets and documents for the bankruptcy plan we would submit to our creditors. But at first, I didn’t know where to begin. I didn’t know the difference between Chapter 7 and Chapter 11. And we couldn’t use our trusted corporate counsel, so we had to search for a good bankruptcy lawyer.

I suffered a spiritual crisis to go along with my financial crisis. The well-being of our employees and their families was resting on my shoulders. Explaining to them that Chapter 11 was our only option was incredibly difficult. It was hard not to feel like I had screwed up.

But I soon realized that Chapter 11 doesn’t mean the end of a company. First, some practical advice if you do find yourself in a bankruptcy: Hire the best bankruptcy attorney you can afford and try to get as much work done up front as you can.

The orderly nature of the bankruptcy process allowed me to work through some of my concerns. It gave us the chance to keep working, whether that meant filing a report or attending a court date, and moving forward one day at a time.

It also helped that I had the support of my parents, who were also my co-owners. We all kept reminding each other that family is more important than business, and that helped get us through.

The bankruptcy also deepened my faith. I come from a strong Catholic family and you can be sure we said an awful lot of rosaries during that time.

We came out of the bankruptcy a year later with our debt renegotiated, still holding onto ownership of the company and our TV station. And I am proud to say we repaid everyone in full, and no one had to take a write-down on their debt. We eventually sold KMCI to the E.W. Scripps Company in March 2000, for $18 million, turning a nice profit.

But that wasn’t the end of our difficulties. For years the media landscape has been rapidly changing. Over-the-air has given way to cable, which is now giving way to online programming. Each change made it harder to make money from media’s lifeblood: advertising. Even though my family started in the newspaper business, we sold our last paper in 1998. And when we sold KMCI, we officially exited the TV business. We realized the TV-station business model wasn’t made for mom-and-pop owners like us.

In 1998 we were again challenged by our tight relationship with HSN when they tried to block the sale of our Kansas City television station to the NBC affiliate. We ended up in a jury trial in United States federal court — something that would have panicked me earlier in my career. But thanks in part to the lessons I had learned during bankruptcy, I kept my cool and it paid off. The jury sided with us and we sold the channel.

I now feel these stressful situations taught me to be more centered, relaxed and thoughtful about business. I examine deals more thoroughly, and deal with crisis more calmly.

These moments that have taught me about Perseverance have also helped me become an Evergreen executive. In fact, I think being Evergreen is the definition of Perseverance. And to me that means never giving up on your company, even when you must go through something you don’t think you can do, like a bankruptcy or having to restructure. It means finding a way to somehow get through it, because you realize you owe it to your company, your team, your employees and your family. You’ve got to do it somehow. There’s no other option.

Christopher Miller is the president of Rocking M Media.

How An Evergreen Legacy Remains Strong After Losing Our Founder

In July 2012, my longtime friend, boss and professional mentor John Gongos phoned to tell me that, after a battery of inconclusive medical tests, he had been diagnosed with stage 4 cancer. But true to his optimistic, stalwart and “I’ll get through this” nature, John remained steady as he confronted a life that would be cut short at the young age of 51.

Just eight days later, I had to do something no COO ever wants to do — gather 100 employees to announce that our beloved leader had passed away from metastatic melanoma.

I had visited his home only a few days prior, and honestly didn’t see this coming. To say it was heartbreaking for me and everyone at Gongos doesn’t even begin to capture the gravity of the day. After all, John had founded Gongos Research in 1991; I was loyal to him and our company since the day we opened our doors.

The day I announced John’s death marked the moment I became a business owner, but it also marked a whole lot more. As Mark Twain said, “The two most important days in your life are the day you were born, and the day you find out why.”

That very day marked my “why” as I embarked on a path to create my own legacy.

Five years in, I can say that if there’s one trait of the Evergreen philosophy I have embraced above the others, it’s Perseverance.

In 1991, at 21 years old, I was one of three marketing researchers who joined John as he launched his own firm. Even though I was the intern, for some reason John was determined to bring me along.

Wide-eyed and driven, I didn’t have much to lose. After all, we already had a key client willing to join us. And working out of two cramped sublet offices was kind of invigorating. We were scrappy, and we did what we had to do. Although I was the youngest, I was in the thick of growing the business — writing proposals, preparing pitches to prospects, designing research studies and delivering the results to our Fortune 100 client.

And it paid off.

At the five-year mark, our firm had grown to 20 or so employees. By that time, we had leased our own office in a new building; not so long after, John made three of us minority shareholders in the business to reward us for our journey thus far.

Through hard work and by putting our people first, we grew. In 2006, we hired our first full-time marketing lead, organized our client-facing teams by industry sector and were about to become a top-50 U.S. market research firm.

But nothing good stays forever, and one of our minority shareholders suffered a massive stroke. While it devastated us all, it made us think more seriously about succession planning.

But this is not the tragedy that brought me to Evergreen.

In early 2012, John Gongos began to have stomach pains.

Prior to what was to become an unthinkable journey, John perhaps had a quiet succession plan of his own.

Nearly 18 months prior to his death, having learned a tough lesson about 50-50 partnerships in a previous business, John presented me with a shareholder edge, and had already appointed me COO. Yet, given his illness, he didn't have the time needed to fully prepare me for ownership. While we discussed succession planning, other priorities took hold. John wasn’t ready for this life turn, and honestly neither was I. A man only 10 years my senior had bestowed upon me far greater responsibility than my present COO duties.

But in 2012, our company’s fate was suddenly firmly planted on my shoulders, and my decisions were about to affect our possibilities and profitability. Sure, as COO I had internalized our growth and opportunities for our employees, but now I had to use my own intuition and experiences to drive decisions.

And there is a fundamental difference between operating as an executive and operating as an owner. As an owner, the weight of knowing that the financial well-being of our employees was now in my hands was humbling to say the least. After all, I had raised three children on our company watch, and the realization that my decisions would affect the spouses and children of each of our employees was an overwhelming feeling that I still carry with me today.

But persevere I did. And I didn’t go it alone.

My first task was to make sure our employees felt safe. Fortunately, they entrusted me to maintain an open-door (and, more importantly, open-heart) policy. Next I put into motion a communications plan to reassure our clients that they could continue to count on our company to support their missions. Slowly, I assembled my version of our company’s leadership team and put a plan into place to empower them and our future leaders.

Once I recovered from the shock of John’s death, I realized these new circumstances had reignited a sense of purpose in me. Three companies had approached me soon thereafter about acquiring us. I turned them all down, as John and I shared a commitment to keeping our company private while building a business that was about far more than profit.

Days before his death, I personally promised John that I would purchase his majority equity from his wife to ensure his family’s well-being. As a result, we held off on other expenditures, such as an office move to accommodate a growing workforce, and more closely aligned our spending with return on investment.

Finally, I needed to consider the future, and the legacy I was going to create. We redefined our evolution into a decision intelligence company. Market forces clearly required we move from collecting insights to helping our clients activate on consumer-centered strategies. After all, the world of big data was upon us and we had to seize it.

This meant hiring new talent — data scientists, visualization experts and designers. But more importantly, it meant gaining buy-in from employees. It was important for me to not rush this evolution and maintain our mantra of growing only as fast as we can find the right people.

Our long-held belief is that once we invest in people, we do all we can to retain them. I’ve made sure that as we evolve as a company, I’m listening and moving at a pace that balances comfort and growth opportunities for our people.

This deliberate pace has served us well. We are well into our evolution, growing to $23.2 million in revenues and 125-plus employees.

As a company that holds restless dissatisfaction as a virtue, there will always be work to do, and I ask our employees — both tenured and new — to Persevere through change, just as I have. I’m grateful for everything John taught me and for the chance to grow into the leader I am today. I know he would be gratified to see how we have progressed, and for the version of Gongos that is yet to come. And I trust that somewhere, somehow, he finds solace in the fact that he was right to fight for an intern.

Camille Nicita is the President & CEO of Gongos, Inc.

How Paced Growth Keeps Us True to Our Brews

Back in the early ’90s, when my company, Odell Brewing, was just a few years old, raspberry wheat beer was all the rage. Remember that? It was a big trend, and all the breweries started making that style.

We thought it was a beer designed for people who didn’t really like beer. We decided not to go down that road, a decision I’m still happy about. I don’t know for certain, but I’m pretty sure that today, not one brewery that hung its hat on making a raspberry wheat beer is still in business.

More recently there was the “hard” root beer trend. This was a huge volume play for the breweries that chose to jump on it, but it didn’t last. My personal opinion was that hard root beer didn’t really taste very good. And the breweries that did follow the trend ended up on a hard-soda hamster wheel, moving on to hard ginger ale and cream ale — always chasing what’s next.

We’ve passed up a lot of trends. Instead, we’ve always focused on creating a quality product that fits our identity, without chasing anyone’s literal flavor of the month.

I believe this approach has served us well so far. Headquartered in Fort Collins, Colorado, we’ve traveled by the North Star of Paced Growth since we began in 1989. In the process, we’ve become a true Evergreen company, though we didn’t even realize it for the first decade we were in business. Today we’re the 27th largest craft brewery in the nation and sold 120,000 barrels last year. We’ve grown a weighted average 11.1 percent annually since opening.

To us, Paced Growth means being able to grow with our own resources, without stretching ourselves to the point that we’re making decisions solely to generate more volume to keep growing. I believe this allows us to be more thoughtful about what opportunities we choose to pursue.

We have followed three principles that have allowed us to stay true to our goal of Paced Growth, which I’ll share.

One, as noted, is not following trends. I call that kind of growth “faddish” growth. Instead, we create our beers using committees inside our brewery, always with the same goal: to make a balanced beer with the right combination of flavors for the style, with no extreme or out-of-character flavors.

A second aspect of Paced Growth, for us, lies in carefully managing how and where we expand. Though Odell Brewing has grown enormously since opening, we’re only in 14 states today, choosing to develop markets that are deep, not broad. Even today, 64 percent of our volume is still in Colorado.

This means we don’t move into a new state haphazardly. We carefully interview our potential distributors to make sure we are putting our beers in the right places. We don’t want them to simply languish on a shelf somewhere. We also spend a lot of time physically on the ground in a potential new market to see if it’s a good fit. We often realize it’s not, and we give ourselves the freedom to walk away. This approach has definitely shaped how we’ve grown.

Our third Paced Growth principal is that we avoid outside money. We choose to finance our growth only with the cash we generate from operations or through traditional bank debt. Not bringing in outside money may constrain the rate at which we can grow, but we maintain complete control of our company, and to us, that’s more important.

This means we’ve turned down overtures for buyouts from the likes of Anheuser-Busch InBev and MillerCoors. We’ve also turned down overtures to sell to private equity firms. The truth is we were never tempted by these conversations at all. Yes, they would provide a payout, but we were much more interested in what the future arc of our business would look like.

We also wanted the people who worked with us to be in this business for a long time and not beholden to outside investors with different, short-term interests. Interests that might change the culture. It’s happened before.

For example, in 2015 Constellation Brands bought Ballast Point Brewing & Spirits. All three founders were subsequently gone within a year and a half. We didn’t want that.

Instead, Odell Brewing became employee-owned in 2015. Now 51 percent of the company is owned by executive team managers, the founders own 30 percent, and 19 percent went to an employee stock plan.

The truth is, it’s been easy for us to stay focused on Paced Growth because we like what we do and never started this for a big payday. It was what we wanted to do with our lives, and still is.

We want our company to last for 100 years and beyond, and we’ve come to understand it’s much easier to take care of the needs of everyone in the business — now and into the future — if we simply grow at a pace that’s sustainable.

Wynne Odell is the CEO and Co-Founder of Odell Brewing Company.

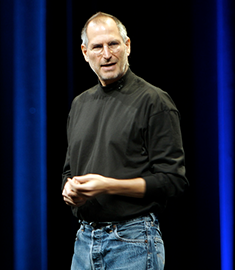

The Evergreen Message In Apple’s Famous Tag Line

This video captures legendary Apple CEO Steve Jobs at a crucial moment. He had just returned to the helm of the company that he had founded, and been fired from 12 years earlier. The company was offering dozens of computer models and had shifted to competing on the same terms as the rest of the computer industry — technical specifications of speeds and feeds. Apple’s brand and team had suffered. In this video, Steve explains to his marketing team that Apple’s brand must speak to Apple’s values and be much more like Nike. Every Evergreen leader should consider Steve’s challenge: Do your brand and marketing speak to what you stand for in the world — your Purpose?

(Photo: Ben Sanfield)

How To Harness What I Call Ketchum Flow

Six years ago, my family and I left our busy lives in Los Angeles and moved to Ketchum, Idaho, a town we initially thought of as a vacation spot. Our decision was not based on hours of agonizing discussions. Instead, it was based on feeling and instinct.

In no time at all, I dropped into the Ketchum lifestyle, learning to fly fish, white-water kayak and mountain bike, all in the springtime of my mid-50s. Trail running became an obsession. I found these new activities all had one thing in common: They all triggered and engaged me in the experience of flow. I have since come to apply the techniques of flow to all parts of my life, with dramatic results. I am happier, more productive and more focused.

I’ll return to my story in a moment, but first let’s define what flow is and why it’s important, especially to an Evergreen business. Many of us have experienced flow, particularly during some kind of athletic endeavor. It’s often referred to as being in the zone. It’s those times of uninterrupted concentration, focused on a specific goal when you are responding to instantaneous feedback. Time collapses. You perform optimally. You are so involved in an activity that nothing else seems to matter. As explained by Steve Kotler, co-founder of the Flow Genome Project and author of The Rise of Superman: Decoding the Science of Ultimate Human Performance, flow has four key attributes: selflessness, timelessness, effortlessness and richness. The synthesis of these is what drives creativity, enhances performance and generates deep sensations of satisfaction and joy.

This might sound a bit fuzzy, but there’s a real science to flow and deep data that quantifies its impact. The reason flow amplifies performance, learning and creativity is that when a person is in flow the brain produces a cascade of neurochemicals: norepinephrine, dopamine, anandamide, serotonin and endorphins. All of these are performance-enhancing chemicals and feel-good drugs. A 2013 study by McKinsey & Co. found that when executives operated at peak levels — in flow — their productivity increased fivefold. Unfortunately, these same execs reported they and their employees were in flow just 10 percent of the time. Imagine the potential outcomes of boosting that number.

So, how can we learn to tap into a flow state more regularly? Experts in this space believe one trigger is to do something of a high consequence, to take a risk. Risk drives focus in very specific ways. Fortunately, it doesn’t have to be physical risk. It can include leaning into business-related ideas that have some element of social, creative or environmental uncertainty. Taking risks, moving out of a comfort zone triggers the neurochemicals associated with flow, which are proven to help you focus and take in more information and process it quickly. Flow jacks up pattern recognition and makes it easier to link ideas together. It is this lateral thinking where the “a-ha!” moments of creativity can evolve.

I first learned about flow 20 years ago through the work of Hungarian psychologist Mihaly Csikszentmihalyi. At the time, I was working at the top of the media food chain, as a president for HBO and before that, Warner Bros. TV. Deeply intrigued as I was by the concept of flow, I didn’t apply the tools and techniques in any consistent manner.

Moving to Ketchum changed all that. I was surrounded by flow masters: extreme athletes and professional adventure junkies. I began testing my body in new ways. In the process, I learned the practical value of flow, because when you are bombing down a steep single-track trail on a mountain bike, wavering focus has immediate consequences that are quite unpleasant.

Ultimately, chasing flow states, in all aspects of my life, became a habit. Wanting to embrace the state as often as possible, I took a giant leap, left the corporate world for that of an entrepreneur and started what is today Flow Media Partners, a media advisory and transactional company I run out of Ketchum.

Surrendering to the unknown felt surprisingly exciting and satisfying, perhaps because I was unattached to any particular outcome. All that mattered was the possibility of the moment. That’s when things began flowing. In no time at all new connections, new projects and new experiences came flying into my world. I even coined a phrase for my state of mind at that time: Ketchum Flow.

I became more comfortable pursuing riskier ideas. For example, the day Oprah Winfrey announced she would be ending her talk show, my former partner at Warner Bros. TV, Dick Robertson, called with an idea to put Rosie O’Donnell back on TV in Oprah’s time slots. We had syndicated “The Rosie O’Donnell Show” back in 1996, and for six years it had been the second most successful talk show behind Oprah’s. The decision to do this happened in an instant even though it put us over the tip of our skis with no safety net.

Since Rosie’s original show had gone off the air, many industry insiders viewed her as damaged goods and high-risk. To us, we knew what she was capable of and believed she could, with the right show, succeed in the slipstream left by Oprah’s wake. We decided to do all of this without a studio behind us, something our counterparts in the industry thought was crazy. But we ultimately made a deal for the show with the NBC Owned and Operated Stations and the Oprah Winfrey Network. Unfortunately, “The Rosie Show” did not perform as hoped, but the deal was immensely lucrative for all the partners.

In many ways, Evergreen companies are more naturally designed to embrace and foster flow, if for no other reason than that they play for the long game and are not bound by the Pavlovian demands of quarterly earnings reports or the arbitrary exit strategies of private equity firms.

To create a flow-encouraging environment, give employees the freedom to step over the edge. They have to know the business allows them to take chances, but they need to feel safe doing so. There are different ways to foster this culture. For example, company leaders can host seminars or training sessions on flow.

This quote from Steve Kotler feels meaningful for Evergreen executives: “If your company is not incentivizing risk, you are denying access to flow.”

Scott Carlin is the Founder of Flow Media Partners.