The First 401(k)

- Bruce White

- Johnson, Kendall & Johnson

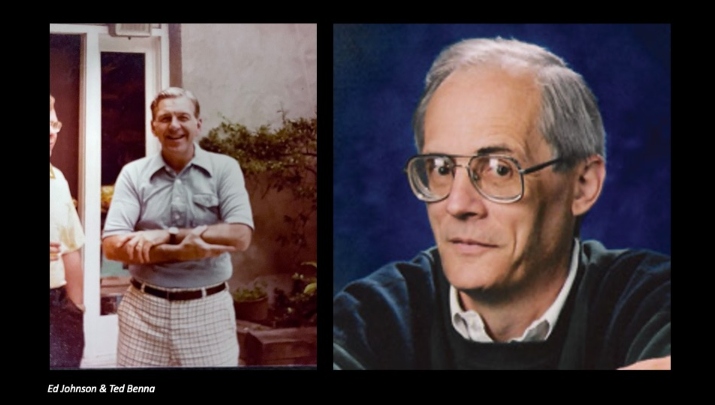

Today, the 401(k) is the standard for retirement savings in American companies of all sizes, industries, and ownership structures. Would it surprise you to learn that this has only been true for about 40 years? The very first 401(k) savings plan was created in 1980 by Ted Benna, an employee at the former parent company of Johnson, Kendall & Johnson (JKJ), the Johnson Companies. Benna’s pioneering plan was and remains one of the most important and wide-ranging People First developments across businesses nationwide.

In the 1980s, the Johnson Companies contained several divisions, the largest of which, Johnson Administrators, administered data for third parties on its considerable computer systems. A smaller division, Johnson Benna, did consulting on retirement plans. They mostly worked on non-qualified executive benefits plans for their clients, many of which were Fortune 500 companies.

As the legendary story goes, Benna was working one weekend, trying to figure out a structure for a client’s top executives to defer taxes on some of their significant cash bonus payments. He stumbled upon a piece of tax code that had existed for a couple years but that was not widely used – it was subsection k of section 401 of the code. 401(k) allowed for the tax-free deferral of dollars today to build income for the future. It did not specify whether the tax-free deferrals were limited to employees or not, nor did it apply to any specific income levels. It was not clear to Benna whether the IRS would allow for it to be used on a large scale, so he put the question to the IRS directly. They agreed with his interpretation and said they would allow it.

Although the code was written for use by high-income employees, Benna realized the opportunity for all employees. He drafted a plan and pitched it to his client, but they decided they were not interested in pioneering something so new and untested. At the risk of seeing it die before it got off the ground, Benna and company founder Ed Johnson decided that the only way they were going to get to test this was to deploy it in their own company, and so the first 401(k) was born.

I did not join the Johnson Companies until 1986, so I was not part of this pilot plan, but we have a woman who still works here at JKJ who was. She’s worked for Johnson since she was 18. Before joining the Johnson Companies, I did have a 401(k), starting in about 1984, which gives you an idea of how quickly this idea caught on and became mainstream.

Ted Benna did not create the 401(k). His genius was in discovering it and realizing its potential. As he pondered its possible usages, he saw that while the appeal might be great for high-income employees, it was going to be a harder sell to lower income workers, who would likely prefer to get all of their salary and bonuses up front. So, he came up with the part that represents his greatest innovation–the addition of employer matching contributions. The prospect of doubling your money as soon as you put it into your account was such an obvious win for employees at all income levels that they signed on in great numbers.

Because it had appeal to all employees in participating companies, all of a sudden, a whole sector of the workforce, who up until this time had put little thought into retirement savings, had cause and a structure to think about planning for their retirement. Aside from pensioned employees, who typically worked for government or state companies or who were union members, they had relied on savings accounts or on family to take care of them in their old age. With the advent and standardization of the 401(k), workers at every level suddenly gained the freedom, security, and dignity to plan for the retirement they wanted instead of scraping by as best they could manage. With life expectancies increasing, this was even more important than it had been in generations past.

The 401(k) has several distinct advantages over the pensions that were the standard before it was created. First, if employees start early, thanks to the employer contributions and the compounding effect over time, they can accumulate significant wealth. Second, the 401(k) has great portability, as compared to a pension. In a world where people change jobs much more frequently than they did in past generations, this is an enormous advantage. Finally, employees do not have to rely on employers to fund pensions; in principle, employers promised to fund them, but volatility, a few bad years, or other market forces could come along and wipe them out, and then employees would be out of luck. The 401(k) gives individuals control over their money and therefore control over their own lives.

The 401(k) is not a perfect tool. Nor did Ted Benna foresee how ubiquitous it would become. His initial intention was not to replace the Defined Benefit system for pensions; he wanted the 401(k) to be a supplement to it, to enhance retirement savings. He always expressed some regret that the 401(k) plans started a trend to replacing Defined Benefit plans versus enhancing them.

Today, the retirement savings landscape continues to evolve. For some small companies, we are learning that certain IRAs might be a better plan. In fact, Ted Benna is still helping companies design plans for their employees to save for retirement, and his current focus is on smaller companies who are often not best served by the plan he developed. But the extent to which Benna’s work revolutionized the way Americans think about saving for retirement has changed the conversation completely. The idea that all employees, and not just the top earners, can and should have the means to build security for their retirement may seem obvious to us today, but it was not at all just 40 years ago.

Here at JKJ we are extremely proud to be part of this history. As an Evergreen® company, when my partners and I bought out our division of the Johnson companies, we doubled down on the Evergreen mindset that Ed Johnson and Ted Benna intuited in so many ways. Our own 401(k) is an important part of how we take care of our employees, alongside our ESOP, through which we offer profit sharing. And we still work on creating and managing employee benefits and 401(k) plans for our clients. We are carrying forward Ted’s legacy and will always put taking care of our people at the center of what we do and who we are.

More Articles and Videos

Both/And Thinking: Harnessing the Positive Potential of Tensions

- Marianne Lewis

- Carl L. Linder College of Business, University of Cincinnati

Leading Through Uncertainty – Tugboat Institute® Summit 2025

- Jackie Hawkins

- Tugboat Institute

Get Evergreen insight and wisdom delivered to your inbox every week

By signing up, you understand and agree that we will store, process and manage your personal information according to our Privacy Policy